Careshield Life Upgrade Aviva

Why do we need CareShield Life. How do Aviva MyCare and MyCare Plus claim work.

Why Aviva Mylongtermcare To Add To Your Careshield Life Coverage

There is a 20 perpetual discount promotion in this current period as shown above.

Careshield life upgrade aviva. Careshield Life Caring For You. Incomes PrimeShield has the lowest overall premium. Before we start examining Aviva MyCare we need to first understand how the basic Eldershield plan works.

Payouts increase till age 67 or until a person makes a claim whichever is earlier. If youre looking for the lowest premium go with NTUC Income. 4 Shenton Way 01-01.

CareShield Life ElderShields most recent upgrade is a long-term care insurance scheme that seeks to alleviate the costs of personal and medical care should you become severely disabled. AVIVA MyLongTermCare and MyLongTermCare Plus have more flexibility and on the 4 highlighted differences seem to offer more value. COMPARISON OF CARESHIELD LIFE SUPPLEMENTS AVIVA GREAT EASTERN LIFE INCOME MYLONGTERMCARE MYLONGTERMCARE PLUS See Note 1 GREAT CARESHIELD ENHANCED ADVANTAGE CARE SECURE Monthly benefit 200-5000 in increments of 100 on top of CSHL payouts Option for level or escalating monthly benefits at 2 3 per annum.

Such as png jpg animated gifs pic art symbol blackandwhite picture etc. In such page we additionally have number of images out there. He is certified to have failed more than 3 ADL.

CareShield Life to open to people born in 1979 or earlier with careshield life enhancement careshield life seedly careshield life upgrade CareShiel. Download all royalty-free images. Protect Your Family - Act Now.

As ElderShield is administered by the private insurers you may approach your insurer for any requests and enquiries pertaining to youryour dependents ElderShield plan. What is CareShield Life. 1 in 2 healthy Singaporeans aged 65 could become severely disabled in their lifetime.

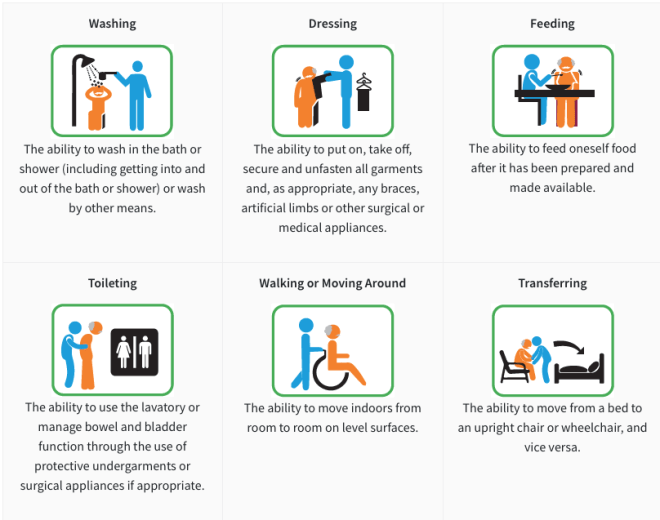

Why do we need CareShield Life. Long-term care when we cant perform 3 out of 6 activities of daily living. We Have got 5 pics about Careshield Life Payout images photos pictures backgrounds and more.

For comparison the premium term chosen is ongoing mode and until age 99. Severe disability can happen at any age due to. Summary of Leveled Annual Premium Payout Table and Comparison Aviva MyLongTerm Care Plus Male Female Pay till Age 99.

2324month expenses is required on average for long-term care needs. By clicking Submit you consent to Aviva and Aviva related companies to contact you for the purpose of receiving updates on CareShield Life. Long-term care can be costly and prolonged.

The contact details of the three ElderShield insurers are. Save up to 70 on Life Insurance in. How Basic Eldershield plan works.

Avivas LongTerm Care Plus offers lifetime protection and bumps up your payouts by 200 to 5000 a month when you are unable to perform at least 2 out of the 6 ADLs lower than CareShield Life. CareShield Life Upgrade Review Service. Aviva MyLongTerm Care Level Premiums.

I also consent to Aviva using disclosing or transferring your personal data in this form to Aviva related companies third party providers or intermediaries whether located in Singapore or elsewhere. Careshield Life supplement payout. Claim under Aviva MyCare.

Long-term disability support scheme CareShield Life will soon be open to Singaporeans and permanent residents born in 1979 or earlier the. Aviva vs Great Eastern vs NTUC Income Premium Comparison To help you get a general idea of what you will be paying for premiums lets look at these two tables below. However as the supplements are only offered by the 3 insurance companies.

This site is an open community for users to share their favorite pix on the internet all pics or pictures in this web are for personal images use only it is stricly prohibited to use this picture for commercial purposes if you are the creator and find this picture is shared without your permission please kindly raise a DMCA report to Us. Long term care studies has put the average estimated expenses to be around 2324month as required in 2018. CareShield Life is a national long-term care insurance scheme that provides basic protection against the costs of severe disability.

Careshield life upgrade aviva. If youre searching for Careshield Life Payout subject you have visit. Careshield Life Upgrade 2 out of 6 ADL Payout Premium Table.

Long term care studies has put the average estimated expenses to be around 2324month as required in 2018. Consider the case of a 42-year-old Mr Lim who is an ElderShield400 policyholder and bought MyCare or MyCare Plus with S1000 monthly benefit payable for a lifetime. Premium Table Comparison.

Careshield life provides amounts from 600m which is insufficient for nursing home cost and barely sufficient to employ a maid. The first table is for those who want to maximise the 600 annual Medisave withdrawal limit to pay for their CareShield Life Supplement policy. The first 600 annual premium is payable by Medisave.

The first 600 annual premium is payable by Medisave. CareShield Life is a national long-term care insurance. 1600 per month premium of 57797 per year 100 payable by Medisave from 2020-2025 rates will be readjusted by based on recommended premium adjustments thereafter.

But only if no claim is made. You dont need to do anything to be included into the basic CareShield Life its automatically enrolled. The MediSave Additional Withdrawal Limit of 600 applies.

Aviva Eldershield upgrade gives you the highest monthly allowance of 1200 1600 per month. 3 in 10 could remain severly disabled for 10 years or more. How to Upgrade Your CareShield Life.

Save up to 70 on Life Insurance in. Every Singaporean upon turning 40 years old will be enrolled into the basic Eldershield scheme. Because MyCare is an upgrade to the Eldershield.

This is defined as the inability to do 3 out of the 6 Activities of Daily Living ADLs. We have summarised the premium for careshield life upgrade between Aviva Great Eastern and NTUC for your reference. Aviva has an ongoing promotion of 20 perpetual discount and the premium below is NOT reflected and is before the discount.

If Mr Lim has a stroke and is paralysed from the neck down. The first 600 annual premium is payable by. By coupling Careshield Life with the Careshield Life supplement plan I will get at least 2200month payout if I am unable to perform 3 ADLs.

Long-term disability support scheme CareShield Life will soon be open to Singaporeans and permanent residents born in 1979 or earlier the. Under CareShield Life you are covered for life and can receive monthly payouts in the event of severe disability which is determined by the inability to perform at least 3 of the 6 ADL. Careshield life upgrade aviva.

Best Careshield Life Supplements In Singapore 2021 Homage

Careshield Life Supplement Best Upgrade Option Comparison Moneyline Sg

Careshield Life Vs Eldershield Find Out What S Best For You Aviva Singapore

4 Reasons Why Jon Didn T Consider Enhancing His Careshield Life

Aviva Logo Evolution History And Meaning Png Logo Evolution Logo Aviva

Why Aviva Mylongtermcare To Add To Your Careshield Life Coverage

Aviva Savings Retirement And Investment Plans Investing How To Plan Retirement Planning

Best Careshield Life Supplements In Singapore 2021 Homage

Careshield Life Supplement Best Upgrade Option Comparison Moneyline Sg

Review Best Careshield Life Supplement Option In Depth Analysis Tree Of Wealth

Aviva Long Term Care Study 2020 Aviva Singapore

Long Term Care Infographic Aviva Singapore

4 Reasons Why Jon Didn T Consider Enhancing His Careshield Life

Aviva Long Term Care Study 2020 Aviva Singapore

Mylongtermcare And Mylongtermcare Plus Careshield Life Supplement By Aviva Singapore

4 Reasons Why Jon Didn T Consider Enhancing His Careshield Life

Careshield Life Supplements Comparison Aviva Still The Best Cpf3life Com

Aviva Careshield Life Vs Medishield Life What S The Facebook