Careshield Life Upgrade Ntuc Income

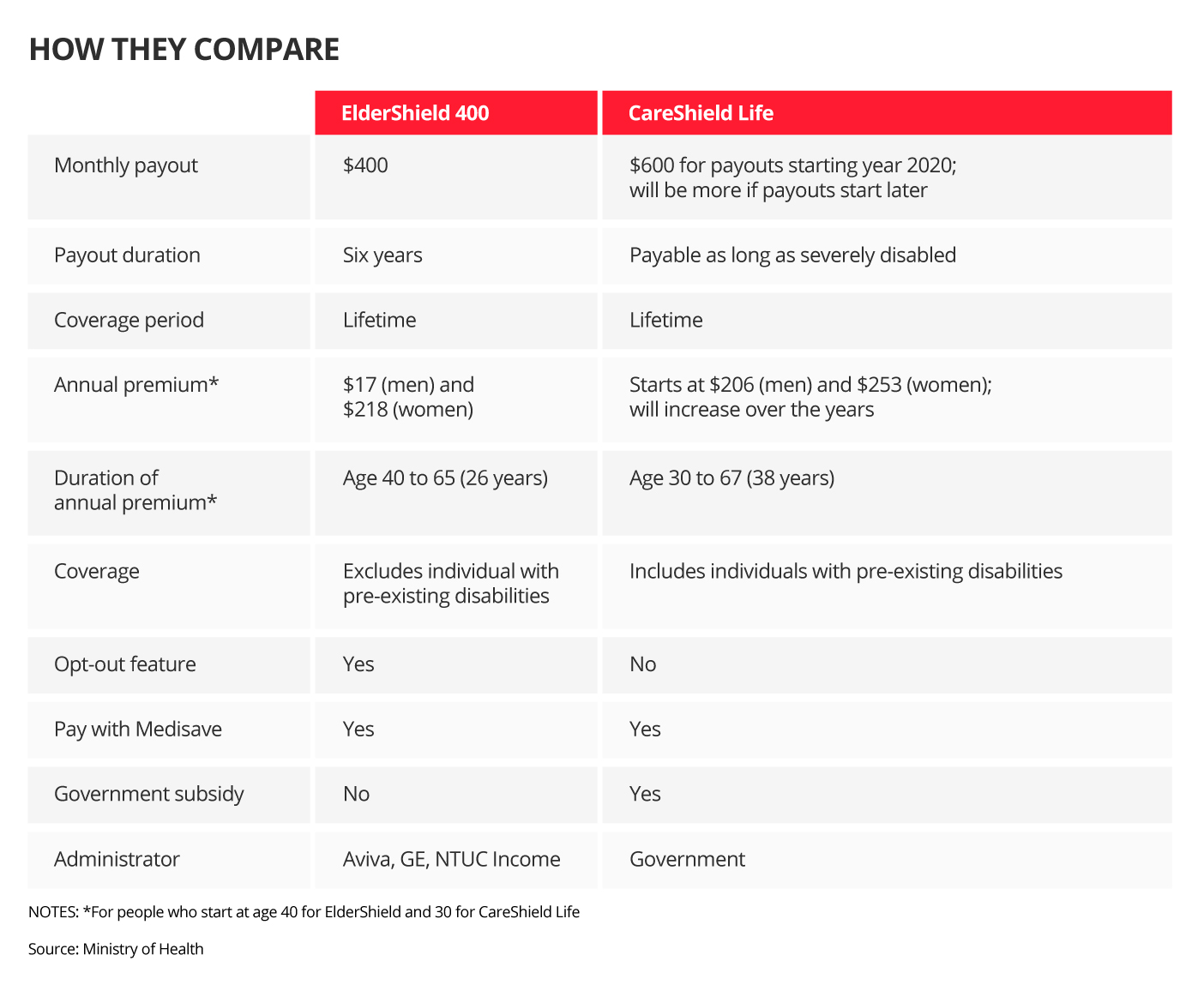

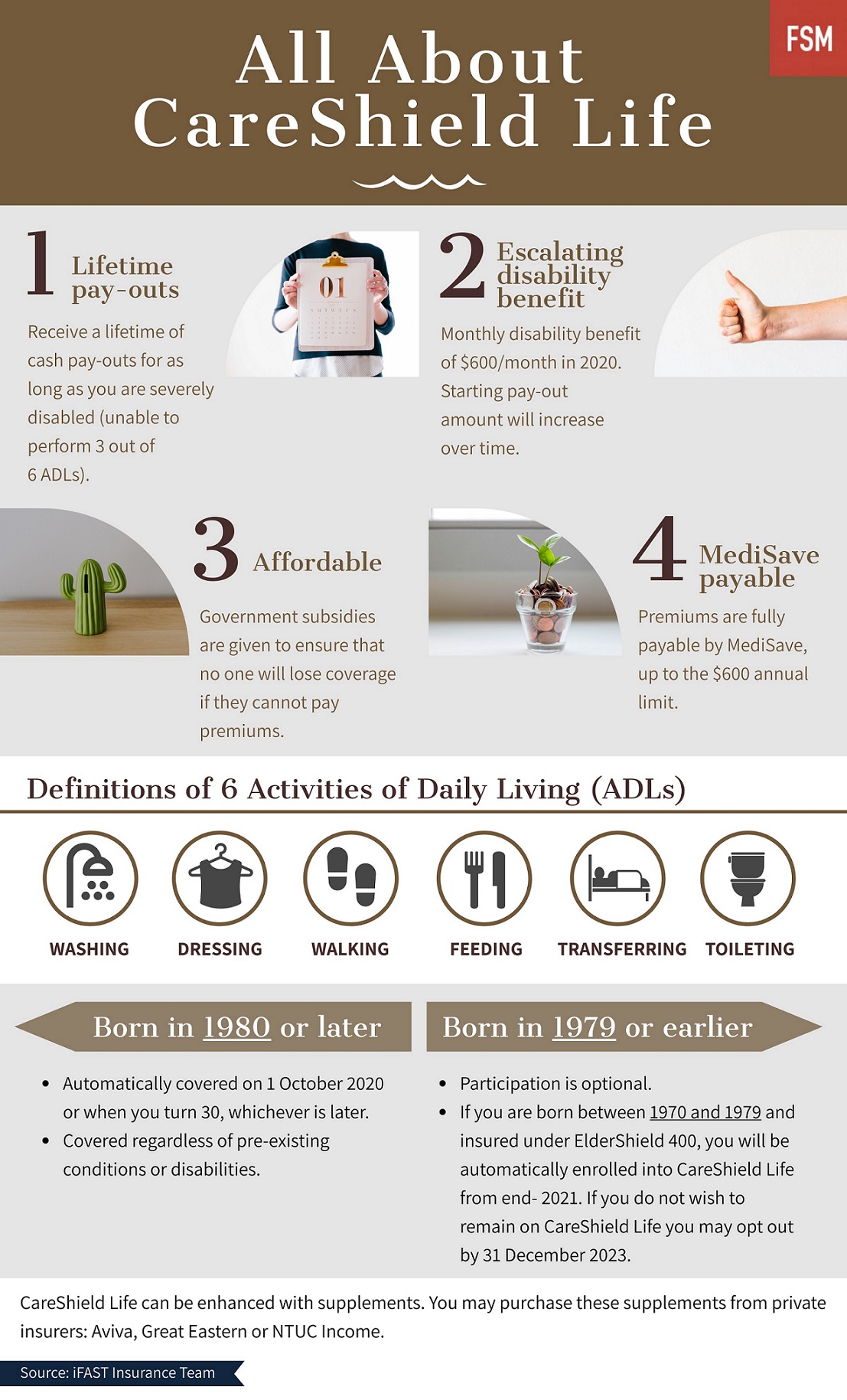

Your plans benefits depend on when you joined ElderShield. CareShield Life is a national long-term care insurance scheme that provides basic protection against the costs of severe disability.

Complete Guide To Buying A Careshield Life Supplement Plan

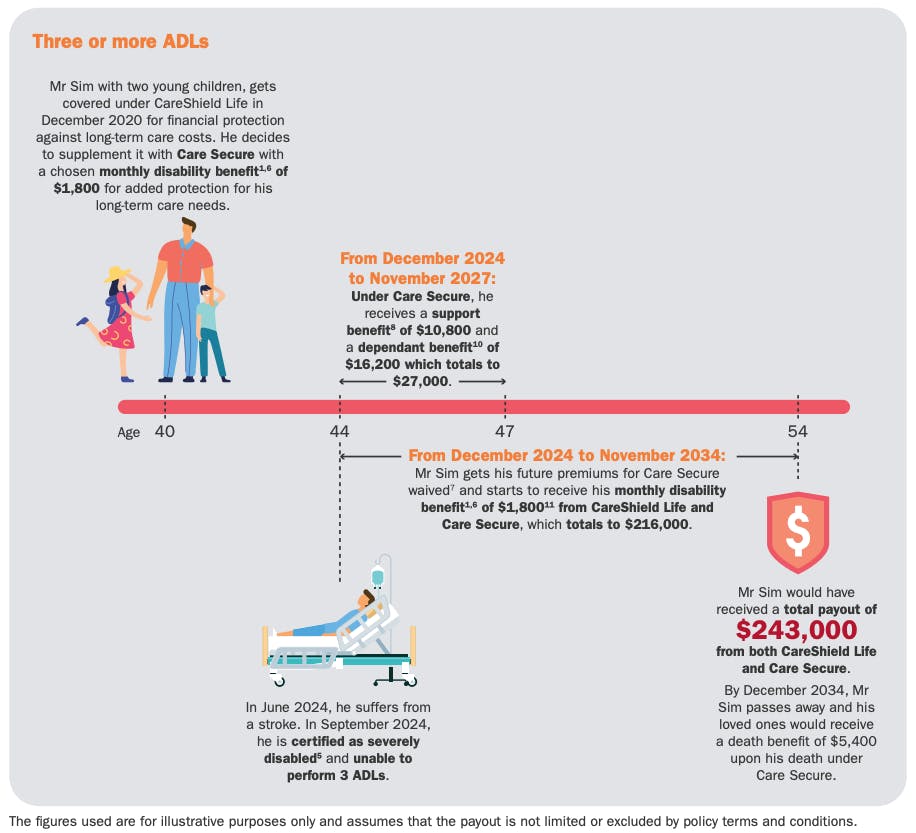

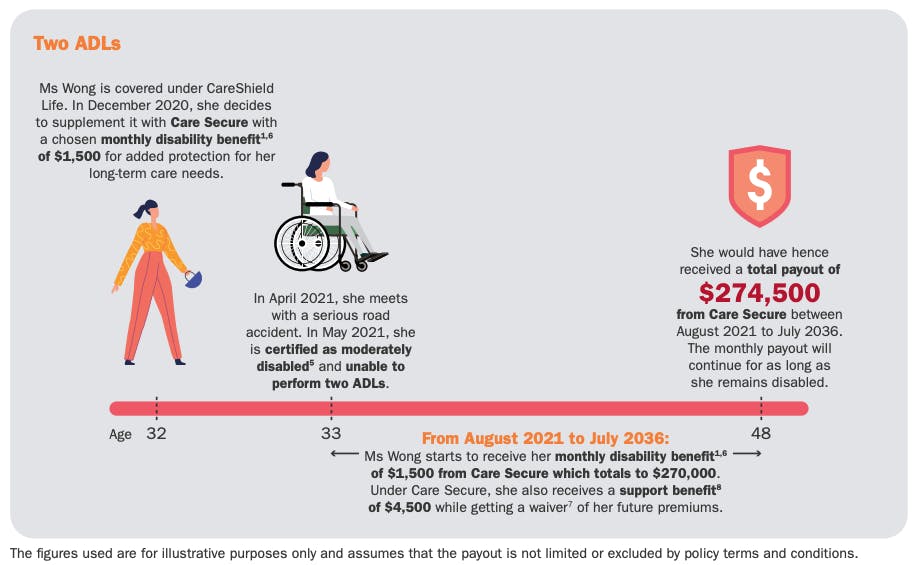

NTUC Income Care Secure is a supplementary plan for CareShield Life.

Careshield life upgrade ntuc income. Coverage commences with just two ADLs instead of CareShield Lifes requirement of three ADLs. Similar to ElderShield you can choose to pay the premiums for CareShield Life supplements using your MediSave account up to a maximum of 600 per year. DetailsAviva MyLongTermCare PlusGE Great CareShield SupremeNTUC Income Care Secure.

But only if no claim is made. 2 out of 6 ADLs. 4 rows NTUC Income Care Secure CareShield Life supplement NTUC Incomes Care Secure offers.

We have summarised the premium for careshield life upgrade between Aviva Great Eastern and NTUC for your reference. Careshield Life Upgrade 2 out of 6 ADL Payout Premium Table. In the event that you cannot do two ADLs NTUC will cover the whole 1200 amount since you are still not eligible for CareShield Life at this point.

CareShield Life Supplements Comparison. Non-participating policy Disability Income Insurance. This will allows you to structure.

Similar to ElderShield you can choose to pay the premiums for CareShield Life supplements using your MediSave account up to a maximum of 600 per year. CareShield Life is a national insurance scheme for Singaporeans and PRs born in 1980 and later. CareShield Life Supplement Upgrade.

To make premiums affordable it pools the members premium. Those born in 1979 or earlier do not need to take any action now. MediSave Payable Up to 600 and Cash.

The CareShield Life payout if any will be administered by the Singapore Government. But in the event that you cannot do three ADLs NTUC will cover 600 and CareShield Life will cover 600. If you become and continue to be disabled we will pay the support benefit.

ElderShield provides monthly payouts of 300 or 400 per month for up to 5 or 6 years. Aviva vs Great Eastern vs NTUC Income. Finding the Best CareShield Life Supplement in Singapore 2021 In summary what the basic CareShield Life provides may be inadequate for your needs.

The information reflected in this booklet is correct as at the time. An example of a CareShield Life supplement is Care Secure by Income. Care Secure is open to Singapore Citizens and Permanent Residents aged 30 to 64 years old last birthday with an.

ElderShield is a basic long-term care insurance scheme targeted at severe disability especially in old age. An example of a CareShield Life supplement is Care Secure from NTUC Income. The design from AVIVA is in addition to Careshield Life payouts which is easy to understand.

Enjoy the flexibility to use up to 600 from your MediSave account per insured per calendar year to pay for your Care Secure premiums. Frequently Asked Questions about CareShield Life. 3 out of 6 ADLs.

NTUC INCOME Care Secure pays in total the sum assured with Careshield Life factored in. If you become moderately disabled we will pay 300 of the disability benefit. Up to 5000 Monthly Payout.

Under CareShield Life premiums based on a man aged 41 earning 2801 amount to 268 after subsidies and participation incentives. The first 600 annual premium is. These CareShield Life supplements help bridge the gap by providing coverage for 2 ADLs or more offering monthly payments yes lifetime too and other payments that can help your caregivers and even your.

CareShield Life can be enhanced with supplements purchased from private insurers. But thats where CareShield Life supplements come in currently there are only 3 private insurers in Singapore offering this one of which is NTUC Income. Both AVIVA MyLongTermCare and AVIVA MyLongTermCare Plus have escalating benefit option of 2 or 3 to match inflation needs.

Aviva Eldershield upgrade gives you the highest monthly allowance of 1200 1600 per month. CareShield Life starts payout upon disability to perform 3 of 6 Activities of Daily Living ADLs while NTUC Income Care Secure starts paying out upon disability to perform 2 of 6 ADLs. Monthly Benefit Amount200 5000 in multiples of 100300 5000 in multiples of 1001200 5000 in multiples of 100 Monthly Benefit.

You can purchase Care Secure at monthly benefit levels from 1200 to 5000 in multiples of 100. These plans will offer additional benefits that can enhance your coverage such as higher monthly payouts think of them as similar to the Integrated Shield Plans that complement. All enquiries applications and claims for the CareShield Life supplements should be directed to the respective insurance company or one of their representatives.

NTUC Income Care Secure product details. To purchase a CareShield Life supplement plan you first need to be enrolled under CareShield Life. Summary of Leveled Annual Premium Payout Table and Comparison Aviva MyLongTerm Care Plus Male Female Pay till Age 99.

Careshield life supplement ntuc income care secure. CARESHIELD LIFE UPGRADE REVIEW guybrush 2020-10-13T1627020800 CARESHIELD LIFE UPGRADE REVIEW If you are born between 1980 to 1990 between age 30 to 40 in 2020 you will automatically be covered under CareShield Life from 1 st Oct 2020. If you are looking for an easier claim definition then go with either Great Eastern or Aviva.

These are disability insurance plans that complement and augment the basic CareShield Life plan but are provided by private insurers Aviva Great Eastern and NTUC Income. If youre looking for the lowest premium go with NTUC Income. Option to get higher monthly disability benefits of up to 5000.

For more information on the careshield life scheme please refer to careshieldlifegovsg. Diy can be exchanged for vouchers including insurediy vouchers ntuc fairprice and cold storage vouchers. Switch to CareShield Life remain on ElderShield 400 or upgrade your ElderShield plan to get higher payouts.

Please note that only Singapore Citizens and Permanent Residents born between 1980 to 1990 aged 30 to 40 in 2020 with a CareShield Life policy are currently eligible to apply. To purchase a CareShield Life supplement plan you first need to be enrolled under CareShield Life. Incomes PrimeShield has the lowest overall premium.

An example of a CareShield Life supplement is Care Secure by Income.

Guide To How Ntuc Income S Care Secure Works Hand In Hand With Careshield Life

5 Things You Need To Know About Careshield Life

What You Need To Know About The New Careshield Scheme Dbs Singapore

Concept Risk Investing Money Security Property Rights Protection Investments Dep Ad Money Security Investing Investing Money Personal Financial Planning

Eldershield To Be Renamed Careshield Life With Higher Lifetime Payouts From 2020 Today

Ntuc Income Care Secure Careshield Reviews And Comparison Seedly

Careshield Life Supplement Best Upgrade Option Comparison Moneyline Sg

Careshield Life Supplement Best Upgrade Option Comparison Moneyline Sg

Our Honest Opinions About Careshield Life And Its Supplements

Review Best Careshield Life Supplement Option In Depth Analysis Tree Of Wealth

-riders/EIS-illustration-2021.png)

Ntuc Income Top Insurance And Financial Planning Company In Singapore

Best Careshield Life Supplements In Singapore 2021 Homage

Best Careshield Life Supplements In Singapore 2021 Homage

Guide To How Ntuc Income S Care Secure Works Hand In Hand With Careshield Life

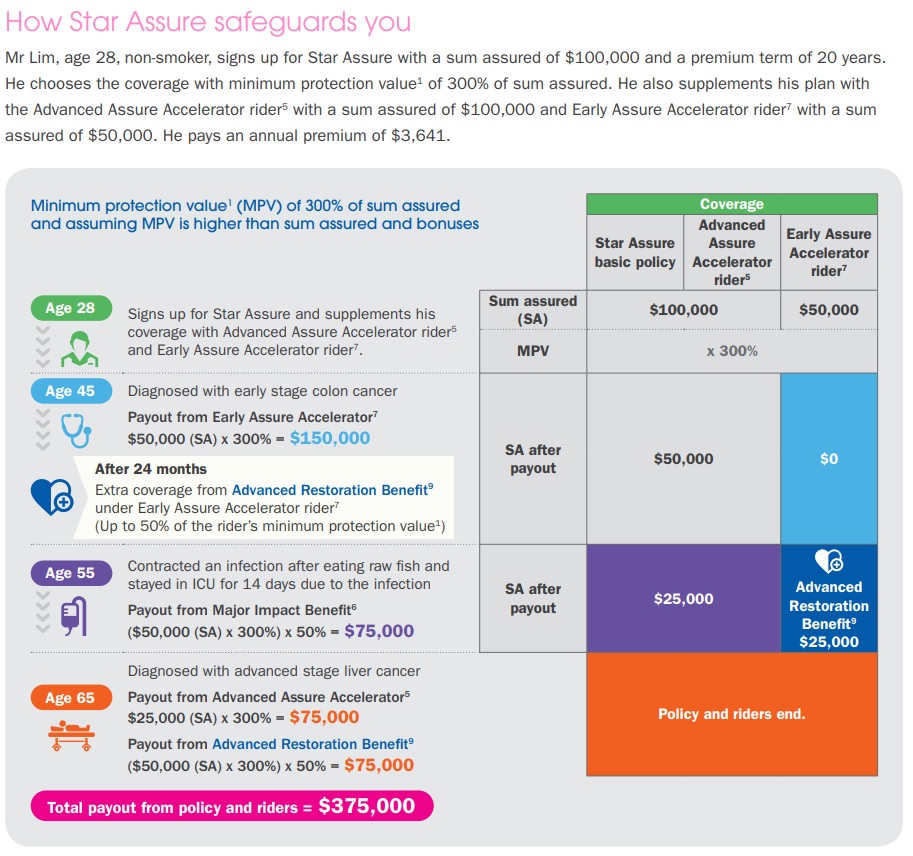

Ntuc Income Star Assure Review

Demystifying Insurance Series The Most Overlooked Insurance Coverage Disability Income Moneyowl

Ntuc Income Care Secure Careshield Reviews And Comparison Seedly