Best way to pay off 3000 credit card debt

With IDFC FIRST Bank offering Indias best credit card interest rates you pay zero interest until your due date for payment and at a flat transaction fee of just 250- only. In order to pay off 3000 in credit card debt within 36 months you need to pay 109 per month assuming an APR of 18.

Pay A Credit Card With A Credit Card Heres How To Do It Credit Card Check Out How To Calcula Paying Off Credit Cards Credit Cards Debt Money Saving Plan

Get personalized quotes from our marketplace of lenders and negotiate your best rate.

. Enjoy 0 intro APR on purchases and balance transfers for 12. 20 or maximum Rs10000. From debt to over 20 credit cards.

What we like about the Citi Double Cash. As Johnny has no savings he has to borrow the 5000 on his credit cards. The fastest way to get a credit card is to apply for a secured credit card.

Earn unlimited 2 cash rewards on purchases. Heres the best way to pay off your mortgage. For instance you may take out a debt consolidation loan or balance transfer credit card and use it to pay off existing debts with better terms.

Credit cards can be a useful tool for financing new purchases and consolidating old debt. It will cost 6211 as interest and 19 monthsto pay off. Take up to 50 off the cost of your flight for every 5000 miles.

There is more than one way to consolidate credit card debtin fact there are three basic ways to do it. Then fill out the declaration. Best Rewards Credit Cards.

Ink Business Cash Credit Card. Options for credit card consolidation. This leaves him with no savings and 5000 of credit card debt at 18.

Limited time offer Earn 200 cash back after spending 1500 on purchases in the first six months of account opening. Find the best rewards credit card that lets you earn cash back free travel or other perks all for simply using your card. In order to pay off 3000 in credit card debt within 36 months you need to pay 109 per month assuming an APR of 18.

Search and apply today. When you have bills to pay its easy to lose track of them and miss a payment. A shorter term means your monthly payments will go up but also that youll pay the loan off faster and be debt-free sooner.

This card rewards you with cash back for everyday spending including 5 back on the first 25000 in combined. For example if you were to transfer 10000 in high interest credit card debt to a balance transfer card your fee might be 3 percent of your balance 300 or 5 percent of your balance 500. Earn a 350 statement credit after you spend 3000 in purchases on your new Card within the first 6 months.

Johnny uses the savings for the emergency. Unlike regular credit cards secured credit cards requires a cash bond which the cardholder must deposit to bank and will be held for a certain period usually 1 year. Setting up a monthly.

In addition to our comprehensive site we have relationships with a variety of trustworthy debt service providers who can ensure that readers financial needs. Snap laying off 20 of its staff in hopes of reducing costs. Pay off debts with savings.

Some of the best credit cards offer no interest on new purchases balance transfers or both for up to. What kind of pay raise can US. 0 intro APR for 15 months from account opening on purchases.

Earn a 350 statement credit after you spend 3000 in purchases on your new Card within the first 6 months. Valid till 15th November. The best way to pay off 3000 in debt fast is to use a 0 APR balance transfer credit card because it will enable you to put your full monthly payment toward your current balance instead of new interest charges.

Two are do-it-yourself and involve taking out new financing to pay off your existing credit card balances. Enjoy 0 intro APR on purchases and balance transfers for 12. Earn a 350 statement credit after you spend 3000 in purchases on your new Card within the first 6 months.

The debt avalanche method of paying down credit card debt can help you save money on interest. This is a fancy way of saying if you spend a certain amount of money in a certain amount of time youll earn a certain amount of points. It may make sense to spend 3000 on mortgage closing costs to save 12000 in interest but not to save.

We write about a range of topics like reducing debt finding student loans getting the best strategy to pay off student loans understanding credit cards and planning for retirement. However the biggest and the best way is through sign-up bonuses and welcome offers. Balance Transfer is back.

The best way to pay off 3000 in debt fast is to use a 0 APR balance transfer credit card because it will enable you to put your full monthly payment toward your current balance instead of new interest charges. Consolidating debt can save money and time. Balance Transfer is back.

All credit card information is presented without warranty. Once its paid off move to the. The Definitive Voice of Entertainment News Subscribe for full access to The Hollywood Reporter.

ZDNet Editor-in-Chief Jason Hiner explains best practices for setup and. Workers expect in 2023. After making minimum payments on all of your credit cards put some extra money on the card with the highest annual percentage rate APR.

Meanwhile if you have built up debt on store cards or another credit card a 0 balance transfer credit card will allow you to move your balances across and pay no interest for a number of months. This leaves him with no savings and. Here are strategies to help you pay off credit card debt.

Anyone who no longer requires a TV licence including those who pay in cash at certain shops or post offices who dont need to do the above can. To help you take advantage of debt consolidation we walk through 7 easy ways to consolidate your credit card debt. Why this is one of the best business credit cards.

If you pay with a TV Licensing payment card youll need to get touch using the TV Licensing contact form or by calling 0300 555 0281 Mon-Fri 830am-630pm. Credit card consolidation essentially gives you a more efficient way to pay off your debt. Earn a 200 cash rewards bonus after spending 1000 in purchases in the first 3 months.

If you pay off your credit card every month you dont have. The Best Credit Cards of 2022. The best credit card can vary from person to person depending on their spending pattern and.

Lets find the best way to consolidate debt for you. See My Options Sign Up. To save you time and money its always best to pay off as much as you can afford each month ideally the full amount.

How To Pay Off Credit Card Debt Fast Who Says What Paying Off Credit Cards Credit Card Design Business Credit Cards

How To Pay Off Credit Card Debt In 2022

6 Ways To Pay Off Credit Card Debt Money

How To Pay Off Credit Card Debt Fast Credible

How To Pay Off 3 000 In Credit Card Debt

How To Pay Off Credit Card Debt In 2022

5 Credit Card Debt Pay Off Tips To Get Out Of Debt Paying Off Credit Cards Credit Card Hacks Credit Card Debt Payoff

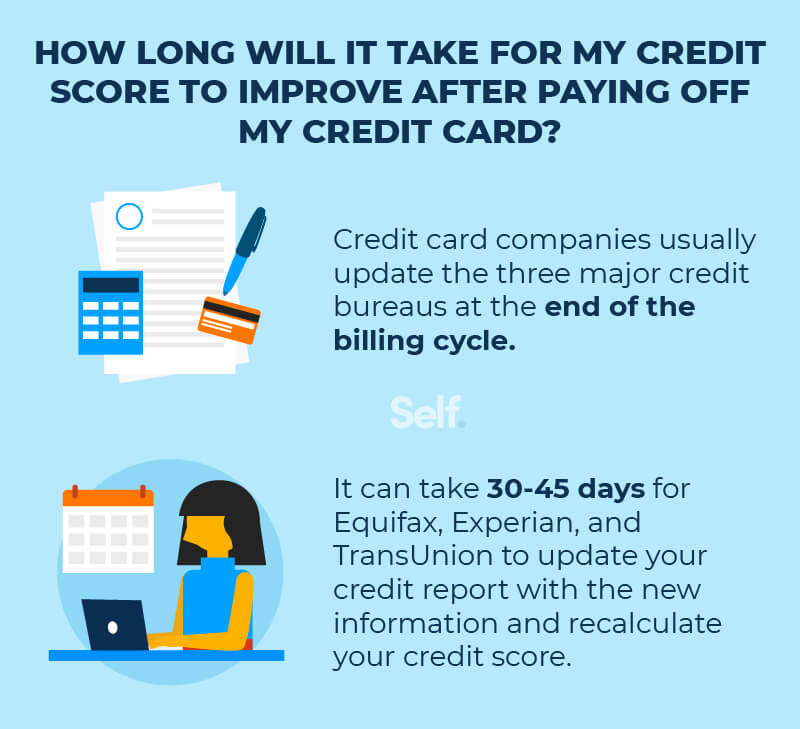

How Much Will My Credit Score Increase After Paying Off Credit Cards Self

How To Use The Debt Snowball Method To Pay Off Debt Nerdwallet

Credit Card Payoff Calculator Credit Card Payment How To Calculate Credit Card Payment Paying Off Credit Cards Credit Card Debt Payoff Credit Card Tracker

How To Pay Off Credit Card Debt 3 Strategies For Relief Guide Youtube

How I Paid Off 10 000 Of Credit Card Debt In 6 Months Youtube

Credit Card Debt Payoff Tracker Printable Debt Payoff Etsy

How To Pay Off Credit Card Debt Who Says What Paying Off Credit Cards Credit Cards Debt Free Credit Card

5 Genius Ways To Pay Off Credit Card Debt Save 1 000 Paying Off Credit Cards Credit Cards Debt Reduce Credit Card Debt

Here S How To Pay Off Debt Quickly With One Frugal Girl S Strategy On How She Paid Off 3 5 Paying Off Credit Cards Credit Card Website Credit Card Debt Payoff

Free Credit Card Payoff Spreadsheet Get Out Of Debt In 2022